Electronic invoicing 2026: transforming a regulatory obligation into a strategic opportunity

Behind the lines of a tax reform lies a profound transformation of the Finance function. From September 1, 2026, all large companies and ETIs will have to be able to receive compliant electronic invoices. One year later, it will be the turn of SMEs to be affected. The aim is not only to combat VAT fraud, but also to modernize invoicing processes. To help you better understand the subject, we interviewed Fabrice QUERE, Finance & Business Transformation Manager at SQORUS.

As he reminds us, this deadline is not just a technical challenge for finance departments. It’s a tremendous opportunity to review their Procure-to-Pay and Order-to-Cash flows, and gain in traceability and efficiency. As a consulting partner, SQORUS is already supporting several major groups in this in-depth transformation.

” For the customer flow, for example, the basic principle is to create a flow from the ERP to the dematerialization operator. The dematerialization operator then transforms this information into a flow (xml-ubl, facture-x, CII…) and sends it to the customer. Switching to EDI makes it possible to secure VAT information, reduce unpaid invoices and ensure reliable payment deadlines. “

Fabrice quéré

Manager Finance & Business Transformation

Electronic invoicing 2026: 5 challenges for finance departments

E-invoicing goes far beyond paperless invoicing. Here are the essential dimensions that CFOs need to anticipate:

1. Tax compliance and governance

There are penalties for non-compliance (up to €15,000 per year). You must be able to issue and receive invoices via a PDP.

2. Efficiency & ROI

The benefits are real: less data entry, fewer errors, and processing costs divided by 10.

3. Process transformation

The reform enables in-depth modernization of the P2P and O2C chains, with improved traceability and automatic reconciliation.

4. International interoperability

Looking ahead, the EU’s ViDA reform will democratize electronic invoicing on a European scale.

5. Change management

Adopting the new system will require training and communication, both internally… and externally. Change management is essential.

Making a success of your transition to 2026 e-invoicing: SQORUS support

SQORUS offers an end-to-end solution to support companies in their e-invoicing compliance and transformation.

1. Compliance audit and diagnosis

- Mapping incoming and outgoing flows

- Identifying flows affected by the reform

- Analysis of repositories (customers, suppliers, legal notices, etc.)

- Measuring risk and exposure

2. Solution selection assistance

- Drawing up specifications

- PDP / OD market benchmark

- Tender animation and response analysis

- Well-founded recommendation with implementation plan

3. Design and modeling of target processes

- Overhaul of P2P and O2C processes

- Optimization and automation of controls (VAT, PO…)

- Modeling new workflows with ERP impacts

4. Project management & technical integration

- Project management, MOA/MOE coordination

- ERP integration → PDP and inbound/outbound flows

- Acceptance, non-regression testing, hypercare management

5. Change management and user support

- Business communication and awareness kit

- User training, test support

- Adoption follow-up and post-deployment adjustments

The offer is backed by an experienced team that has managed e-invoicing projects in an international environment (Oracle, Esker, PeopleSoft…) in a variety of sectors (industry, banking, insurance, distribution).

Electronic invoicing: the keys to success for your company

- Clean, reliable data: to reduce rejects and automate reconciliations.

- Automated processes: to speed up processing cycles and reduce human error.

- Improved cash management: through reduced DSO and a real-time view of outstandings.

- Concrete cost savings: up to 90% reduction in processing costs.

- Strong support from teams: thanks to educational support and involvement.

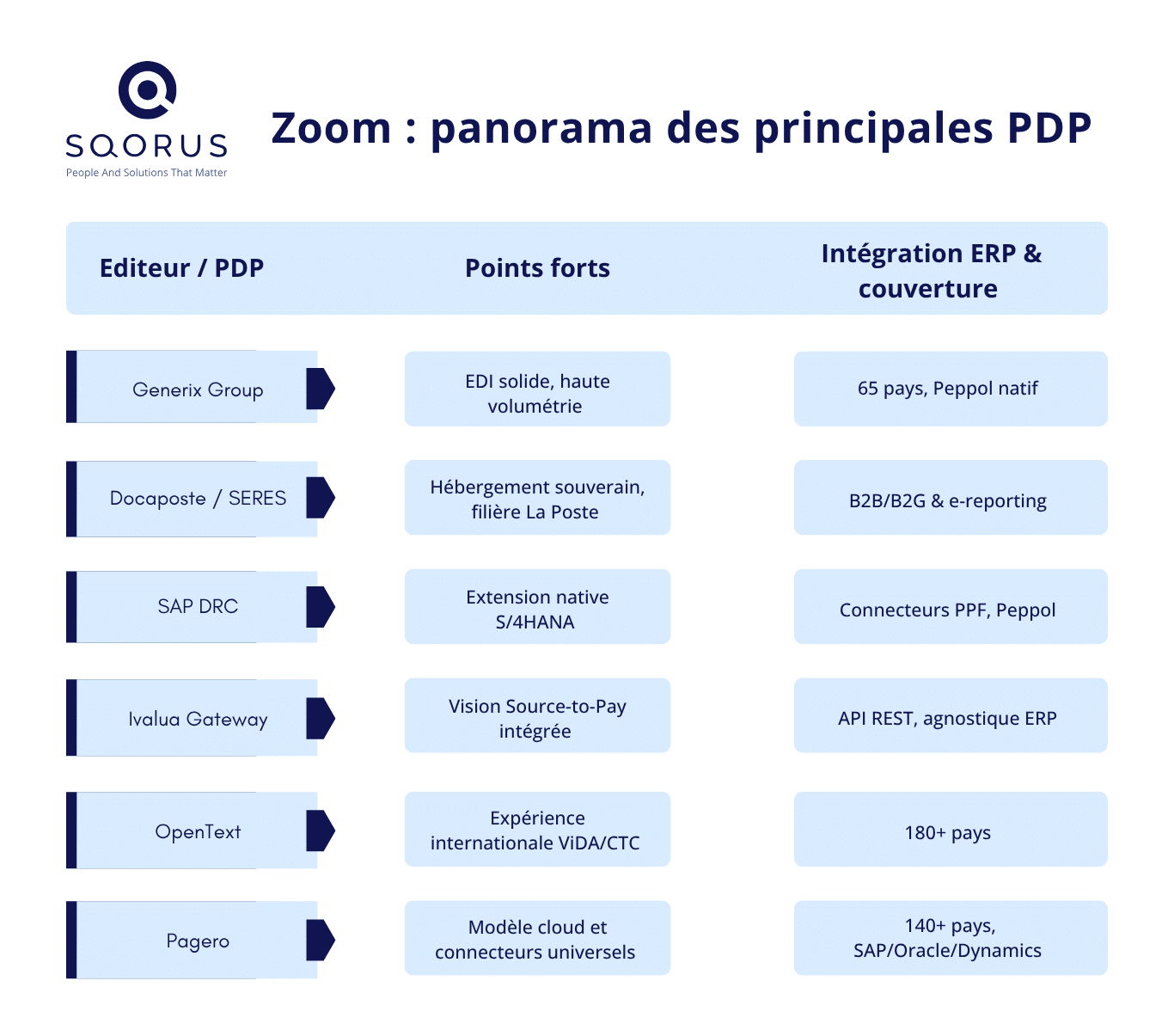

Choosing your PDP for electronic invoicing 2026

Conclusion: transforming electronic invoicing into a financial performance lever

The reform of electronic invoicing is an obligatory milestone. But for the most agile CFOs, it is above all a turning point towards a more modern, more reliable and more strategic finance.

At SQORUS, we believe it’s not enough to be in good standing. It’s time to accelerate. That’s what we do alongside our customers, every step of the way.

Fabrice quéré

Manager Finance & Business Transformation

What next? Why not start with a flash diagnostic (4 weeks) to lay the foundations for your PDP/ERP trajectory?

Contact us!

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.