Electronic invoicing reform: what you need to know

Initially scheduled for July 1, 2024, the timetable for implementation of the e-billing reform has been shifted to allow French companies and the government a better orchestrated transition. While the postponement was agreed by the Minister of Finance in the summer of 2023, the timetable was rejected by the Senate, which wants to see a faster implementation for large companies from July 2025, justifying a significant economic gain by bringing this milestone forward.

Cow can you anticipate the issues and challenges of the new electronic invoicing reform for your company? In this article, you’ll find the major impacts you need to take into account to prepare your company’s ecosystem and get through thee-invoicing reform with peace of mind.

In the continuity of the law of modernization of the economy of August 4, 2008, the reform of the electronic invoice introduced the obligation to exchange the flows of invoicing by electronic way. The General Directorate of Public Finances (DGFIP) and the Agency for State Financial Information Technology (AIFE) are in charge of implementing this new billing system.

The vast majority of French companies are sole proprietorships (3.8 million in 2021) or very small businesses (1.3 million in 2021), and the French government estimates that between 2 and 2.5 billion B2B invoices are circulated in France every year.

Naturally, the new reform on electronic invoicing raises questions for companies about its impact and the timeframe for implementation, as well as the work needed to meet the challenges.

What are the key dates for the implementation of the electronic invoice reform?

Following an initial postponement of the reform, on November 15, 2023 the Senat voted an amendment proposing the possibility of receiving electronic invoices as early as July 2025, which needs to be validated by the National Assembly.

- July 1, 2025: If the amendment is confirmed, large French companies (workforce > 5,000 employees or sales > 1.5 billion euros) will have to be able to issue their invoices in electronic format, which means that all French companies will have to be able to receive them.

- September 1, 2026: Medium-sized companies (number of employees between 250 and 5,000 or sales between 50 million euros and 1.5 billion euros) will be obliged to issue their sales invoices in electronic format.

September 1, 2027: small and medium-sized businesses and micro-businesses will also have to issue their sales invoices in accordance with the reform.

What are the terms of electronic invoicing?

In the common imagination, the electronic invoice is still too often considered as a simple paper document scanned in PDF or other format, then sent by email. However, the framework imposed by the reform brings a new standard and disrupts the billing practices of all companies, in the short and medium term.

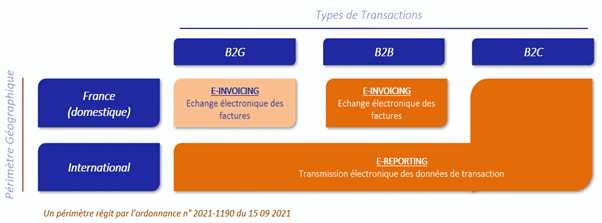

Much more than the edition of a document in an image format, the electronic invoice is defined as a paperless invoice, of which all the stages, from its creation to its integration, are done in a dematerialized way. It concerns all transactions for the purchase/sale of goods and services between companies established in France and subject to VAT. With the new legislation, the edition of a paper invoice will be totally prohibited as well as an invoice in PDF format.

For an invoice to be considered compliant, the following three electronic formats, governed by European standard EN16931 (defining the expected semantic data model), will now be permitted:

- Universal Business Language version 2.1 – UBL 2. 1: structured XML format, meeting the international standard ISO/IEC 19845:2015. It is now the most widespread worldwide.

- Electronic Data Interchange – CII: A structured XML format, using a technical specification to generate message syntax that can be exchanged internationally between inter-industry trading partners.

- Factur-X: mixed invoice file format, combining a structured XML data file with a PDF document.

On the other hand, the State introduces the e-Reporting which allows to transmit to the tax authorities a statement of all the purchase/sale operations which do not fall within the scope of the e-invoicing

.

In addition to the obligations related to the format, new information has been made mandatory. This is the case, for example, with statuses linked to the invoice life cycle (payment, receipt, validation, etc.) and data such as the customer’s Siren number.

E-billing: What is the directory?

The directory is a register of identification data of companies established in France. It is set up within the framework of the reform and will be managed by the AIFE. It is intended to facilitate the exchange of electronic invoices between companies and will allow the identification of those liable for VAT.

Several categories of information will be listed in this register:

- Data identifying the companies receiving the invoices, as well as details of the organizational structure receiving the invoice within each company: SIREN, SIRET, routing code.

- Data relating to the identification of the Platforms of Dematerialization Partners between them so as to ensure the interoperability and the good reception of the electronic invoices.

- Additional data related to B2G invoices.

What tools can I use to dematerialize my invoices?

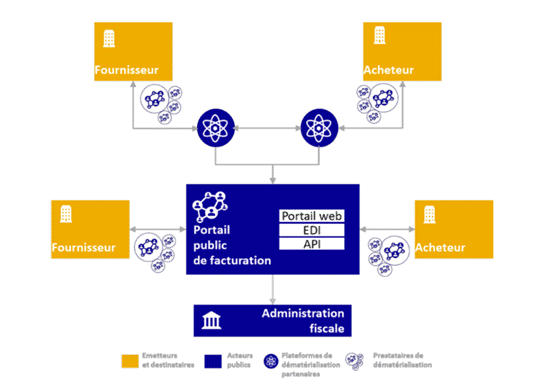

Because of the mandatory nature of the reform, the State has modeled future electronic invoicing flows between buyers and suppliers under a “Y-scheme”. It also identifies the different tool options that can be deployed within companies.

The Public Billing Portal

The Public Billing Portal (PPF) is a free service provided by the State, allowing companies to centralize their billing data. It is also in charge of the management of the public directory and makes the link with the tax authorities for VAT declarations.

Dematerialization Platforms Partners

Partner Dematerialization Platforms (PDPs) are private trusted third parties able to manage incoming and outgoing invoicing flows directly between customers and suppliers.

In order to be a PDP, publishers are required to obtain state certification. They generate invoices in the correct formats, both outbound and inbound.

Dematerialization Operators

Dematerialization Operators (DOs) are also private trusted third parties with the capacity to receive and generate invoices in the expected electronic formats .

However, they don’t have the capacity to issue a bill directly to customers, as no state approval is required.

Conclusion on e-invoicing reform

Ultimately, the preparation according to its ecosystem will be decisive to pass the course of the reform of the e-invoicing. Beyond a new tool to reduce VAT fraud, which the tax authorities have acquired, this is a real opportunity for companies of all sizes to harmonize and modernize their invoicing practices.

The relationship between buyer and supplier as well as their productivity will be improved, with among other things: the optimization of their working capital needs, the drastic reduction of costs and processing times throughout the life cycle of their invoicestheir competitiveness through simplification, innovation and more reliable billing processes and the reduction of the administrative burden of tax returns.

On this subject, SQORUS, a consulting firm specialized in digital transformation of HR, Finance and IT functions, can help you with your e-invoicing issues.

Do not hesitate to contact us to discuss with our experts.

DOWNLOAD OUR LATEST WHITE PAPER

HOW SHOULD FINANCE BUSINESSES TRANSFORM THEMSELVES TO GENERATE ADDED VALUE AND DETECT GROWTH OPPORTUNITIES?

Also read on the topic of digital transformation of finance functions:

- The obligation of electronic invoicing and e-reporting

- Electronic invoicing reform: what you need to know

- What is the role of the finance department today?

- 5 obstacles to the digital transformation of finance functions

- Improve financial processes with automation and RPA

- What changes does dematerialisation bring to the finance function?

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company’s financial transformation

- From a Finance IS to a Finance Data System

- What are the key challenges facing finance managers today?

- What are the key regulatory issues for CFOs in 2023?

- Digitization of the finance function: what should we expect in the future?

- Finance management: what technological tools are available to CFOs?