The role of CFOs is changing

The finance department decides on the budgets allocated to each project. The company’s digital transformation represents a significant investment: the CFO must therefore define the priorities. But it’s not just about the budget. All company activities are affected by this trend, and the finance function is no exception.

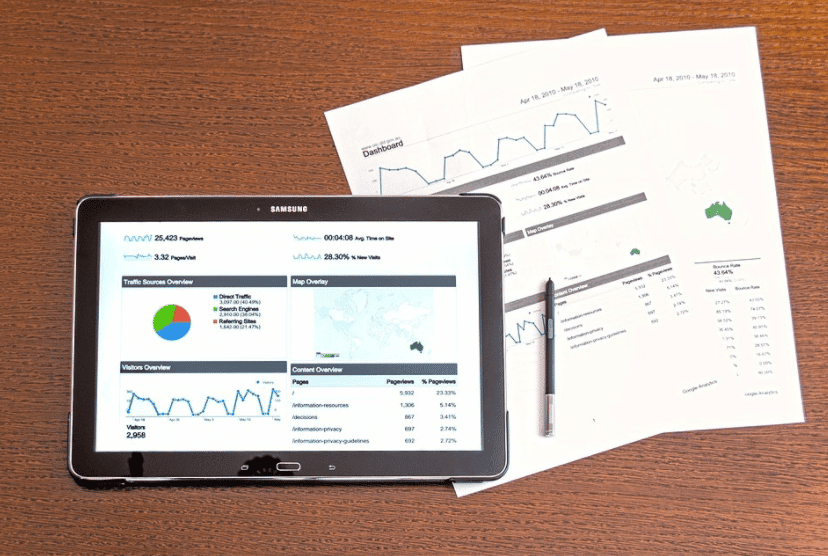

The finance department will not only be interested in the budgetary aspect, but will also be really involved in the project. Data, the company’s true asset, is at the heart of digitalization. The CFO must ensure that these data can be properly used by all the departments that need them, by putting in place all the necessary consultation and management control tools. Cross-functional dashboards should enable everyone to obtain the same level of information.

CFOs and CIOs need to work together

To succeed in its transformation, the finance function will have to rely on all the tools offered by new technologies. Cloud computing, artificial intelligence, machine learning, big data and ERP software are all tools that must be mastered. To do this, the CFO must be able to rely on the CIO to select and deploy them and to involve all employees.

The CIO can guide the CFO in his technological choices and help him select the best solutions to implement to meet the growing needs of the company. He will also be able to assist him in related areas that he does not necessarily master, such as security issues or the legal aspects of data storage and processing.

The CFO can inform the IT department and the project teams about the business processes and the data exchanged. It can help them better control their expenses and obtain the necessary financing.

Transformation of the finance function: meeting the challenges of tomorrow

The multiplication of financial information flows in the company means a considerable increase in the amount of data to be processed. Traditional tools, such as spreadsheets, are now obsolete. The use of big data, combined with artificial intelligence and machine learningis bound to make its appearance in the enterprise.

The concepts behind these tools and their potential applications are still unclear to many professionals. Effective cooperation between the CFO and the CIO on these subjects is therefore, more than ever, essential to meet the challenges of the future.

Digital transformation of the Finance function : how to identify growth opportunities?

Discover how Finance's digital transformation can optimize your company's performance, and effectively identify opportunities for growth.

Also read about the digital transformation of finance functions

-

5 obstacles to the digital transformation of finance functions

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

- Improve financial processes with automation and RPA

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company's financial transformation

- From a Finance IS to a Finance Data System

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.