Standardize and automate processes

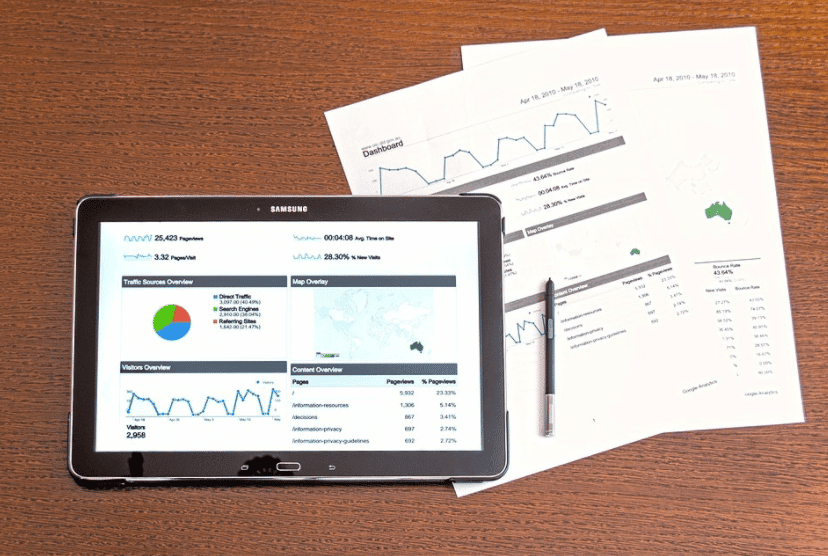

To achieve the goals set by executives, finance departments must become even more efficient. They focus on standardization and automation of various tasks, among the most time and energy consuming. In concrete terms, we can set up computerized posting journals and automatic bank reconciliations.

This quest for additional efficiency will allow teams to focus more on higher value-added tasks, such as monitoring or data analysis.

Train all the players in the finance function

Faced with the many changes underway as a result of various regulatory developments, CFOs need to develop the skills of their teams. Recruiting new profiles is often a costly solution and is only used as a last resort. As a result, they are placing more emphasis on training all financial administrators.

The latter will be made aware of the impacts of the regulatory changes. They will also acquire new work methods and knowledge about the latest computer tools. However, CFOs remain aware of the roadblocks they may face in 2019. Among the most obvious are the lack of investment in training, the difficulty of accepting mobility (especially for older employees), and the resistance to change among teams.

The rise of environmental risk

In September 2018, an online questionnaire was made available to finance departments from companies of all sizes and industries. The report reveals that accounting figures are not the only problem faced by CFOs. They are also concerned about the future risks of environmental degradation.

This concern seems, at first glance, to be relatively far from the initial area of competence of the finance department. A closer look at this phenomenon shows that this risk is only a reflection of the evolution of our society. The stakes of sustainable development have already resulted in the establishment, by the legislator, of strong impacting constraints for a company.

Digital transformation of the Finance function : how to identify growth opportunities?

Discover how Finance's digital transformation can optimize your company's performance, and effectively identify opportunities for growth.

Also read about the digital transformation of finance functions

-

5 obstacles to the digital transformation of finance functions

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

- Improve financial processes with automation and RPA

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company's financial transformation

- From a Finance IS to a Finance Data System

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.