The finance department at the heart of the processing of sensitive information

CFOs receive, store and exchange highly sensitive data. This makes them a prime target for malicious people. Customer care and billing departments are particularly sensitive.

The attack techniques of cybercriminals are becoming more and more sophisticated and are constantly evolving with the new possibilities offered by technology. They can, for example, gain access to customer data by intercepting an e-mail, or issue false invoices.

The purchasing department is also likely to be affected since it holds essential information such as contracts with the company’s suppliers. But the impact of a cyberattack can also extend far beyond the financial dimension. In this way, fraudulently acquired customer data can be resold to a competitor.

In a context of increased competition, any damage to a company’s reputation through the questioning of a distributed product or a questionable financial transaction is likely to put the company in a difficult situation. It is therefore important that the CFO be involved in defining compliance and risk management policies.

Assessing risks VS benefits

While the digital age opens up tremendous opportunities for finance management, it also presents opportunities for cybercrime. This is why all digital transformation projects must be subject to a prior benefit-risk study.

An inventory of internal procedures will also be carried out. The first step is to establish a risk map:

- what data is likely to be of interest to cybercriminals?

- where are they located?

Once this inventory has been carried out, it remains to assess the degree of vulnerability of each of these sensitive data, in order to put in place the necessary tools with regard to the different types of probable attacks.

The company’s human capital also has an important role to play in the prevention of cyber-attack risks. The training of the employees concerned is, in fact, an essential means of reducing the risks. If necessary, procedures and work habits will have to be modified.

The cyber risk must be perfectly integrated by the various actors. Simple reflexes will sometimes suffice, such as not opening a link or an attachment sent by an unknown sender. For the most sensitive data, only those who really need it will be granted administrator rights. In order to respond to complex situations, it will sometimes be necessary to call upon an external firm to map the risks precisely, or to carry out intrusion tests.

In any case, spending on cybersecurity must be commensurate with the risks. Finally, company executives may wish to consider purchasing fraud insurance.

Cybersecurity is not enough

Despite all the preventive measures taken, cybercriminals sometimes succeed. The planned crisis management procedures must then be implemented.

The company’s cyber resilience capabilities largely determine the effectiveness of the response to the crisis situation. The operational nature of the systems for identifying and detecting technological weaknesses plays an essential role here.

Secondly, the immediate mobilization of the actors and departments affected, in accordance with the rules set out in the action plan drawn up for the given event, will be aimed at minimizing the financial and image damage, as far as possible.

Today, the CFO occupies a strategic position in the company’s organization. He is a key player in business development and is able to identify risks and prescribe the necessary measures to protect the company’s interests. There is no doubt about the need for its association with the cybersecurity system.

Role of the CSO (Chief Security Officer) in the financial transformation of the company

The CSO, more precisely known as the CISO (Chief Information Security Officer) when it comes to corporate information systems, is a key person for the finance department.

As a true partner to the finance department, he or she must be able to understand what is at stake in the finance business, what is critical in terms of processes and information, and what the weight of compliance is.

His responsibilities, in order to support the finance department, include:

- information systems mapping,

- audit capability,

- support for new projects,

- the development of a rapid response capability.

P.S.

SQORUS supports its key account customers in the digitalization of their finance functions. With a functional and technical expertise of the main solutions of the market dedicated to the finance business, we implement and accompany our customers in all phases of their projects. With consultants certified in solutions such as Oracle, Netsuite, PeopleSoft, Kyriba and Axway, SQORUS is the preferred integrator of financial solutions on the market.

Digital transformation of the Finance function : how to identify growth opportunities?

Discover how Finance's digital transformation can optimize your company's performance, and effectively identify opportunities for growth.

Also read about the digital transformation of finance functions

- The obligation of electronic invoicing and e-reporting

- Electronic invoicing reform: what you need to know

- What is the role of the finance department today?

- 5 obstacles to the digital transformation of finance functions

- Improve financial processes with automation and RPA

- What changes does dematerialisation bring to the finance function?

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

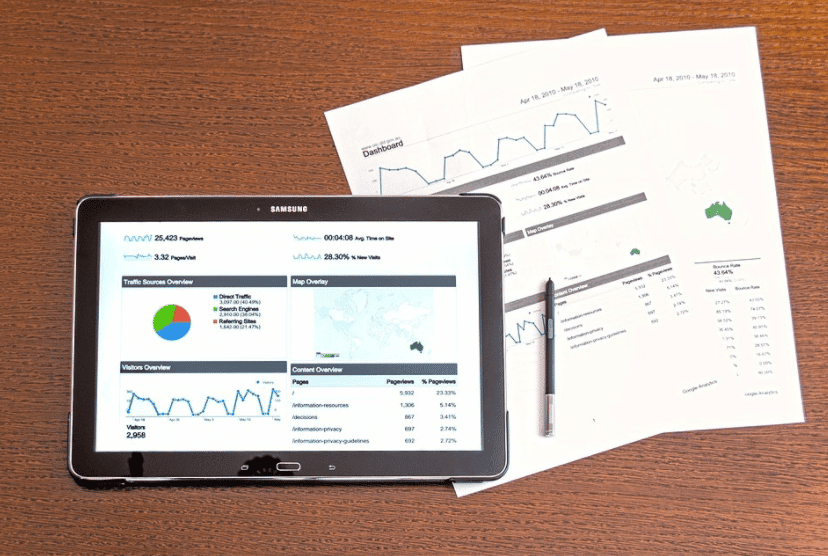

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company's financial transformation

- From a Finance IS to a Finance Data System

- What are the key challenges facing finance managers today?

- What are the key regulatory issues for CFOs in 2023?

- Digitization of the finance function: what should we expect in the future?

- Finance management: what technological tools are available to CFOs?

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.