The obligation of electronic invoicing and e-reporting

With the introduction of the new law on electronic invoicing, many questions are raised about the application of e-invoicing and e-reporting.

In this article, we will guide you to prepare your company for the challenges of this new regulation.

Finance Strategy

By Valérie DELAY, Anouar SANHAJI and Salim BELHADI

Consultant Product Owner Finance IS Projects

Experienced Financial Consultant

Confirmed AMOA Finance Consultant

Taking advantage of the so-called law on the modernization of the economy (LME) of 2008, a first shift towards the electronic billing had been crossed in France since all companies, trading in the public sphere, were obliged to issue their invoices in dematerialized format as of January 1, 2017, via the Chorus Pro.

With the Finance Act 2020 amended in 2022, a new framework is established to extend electronic invoicing or e-invoicing, to all commercial exchanges taking place in the private sphere, whether in B2B (Business-to-Business) or B2C (Business-to-Consumer).

By 2024, all companies subject to VAT in France, regardless of their size, will have to be able to receive supplier invoices in dematerialized format. As for the issue, a progressive implementation schedule, extending from 2024 to 2026 depending on the size of the companies, has been established by the tax authorities.

E-reporting is also becoming a standard for companies for certain transactions that fall outside the scope ofe-invoicing.

These obligations naturally raise new questions within companies about: the scope of application ofe-invoicing and e-reporting, the impact on their application environment and the level of alignment required with the expectations of the reform.

The Concepts of E-Invoicing and E-Reporting

Both e-invoicing and e-reporting are governed by Article 26 of Amending Finance Law No. 2022-157, which specifies their scope of application. In practical terms, paper invoices or those in image format (PDF, JPEG, etc.) sent alone and/or by email will disappear.

E-invoicing corresponds to the dematerialization of an invoice into a structured data format throughout all stages, from its creation to integration. To secure the implementation of the reform, the DGFIP (French Tax Authority) and the AIFE (Interministerial Agency for Financial Information Systems) have standardized the exchange modalities of e-invoices by defining the specificities related to:

- semantic aspects (list of data contained in the sent file);

- syntax concept (supported file formats);

- file transmission channels (API services, EDI, etc.).

To be considered compliant, an electronic invoice must adhere to one of the three formats imposed by the European standard EN 16931, which are:

- Universal Business Language version 2.1 – UBL 2.1 (the most widely used XML format worldwide);

- Electronic Data Interchange – CII (structured XML format used for cross-industry business partners on an international scale);

- Factur-X: (structured XML file accompanied by a PDF document used in Europe).

The scope of e-invoicing applies to all domestic B2B transactions conducted between VAT-registered companies domiciled in France.

E-reporting is a structured electronic file that allows for the direct transmission of billing data to the tax administration, beyond the scope of e-invoicing. Its scope is defined by Article 290 of the General Tax Code and includes:

- international B2B transactions;

- domestic and international B2C transactions;

- payment data only for service transactions falling under articles 289 bis and 290 of the General Tax Code.

How can you anticipate the challenges and stakes of the new electronic invoicing reform for your company? Find all the necessary information to prepare your company’s ecosystem and navigate the e-invoicing reform in a previous article: Preparing Your Company’s Ecosystem and Successfully Implementing the E-Invoicing Reform.

New Mandatory Information for Invoices

The tax administration has defined categories of data that are mandatory in both e-invoices and e-reportings. The objective is to standardize invoicing practices and ensure the readability of data by different systems used by companies and the tax administration through optical character recognition (OCR).

In the context of e-invoicing, the following information must be included in the invoice files. In total, 26 pieces of information will be required during the “Startup” phase (first deployment wave), and 8 will be required during the “Target” phase (final deployment wave).

In addition to the currently mandatory information on all invoices, 4 new pieces of information will be introduced with the new reform:

| NEW MANDATORY INFORMATION ON ELECTRONIC INVOICES | LAUNCH | TARGET |

|---|---|---|

| SIREN - customer | X | |

| Transaction category: supply of goods (LB) / supply of services (PS) / double (LBPS) | X | |

| Option for tax payment on debits | X | |

| Address of delivery/service provision, if different from customer's address | X |

Source: https://www.impots.gouv.fr/specifications-externes-b2b

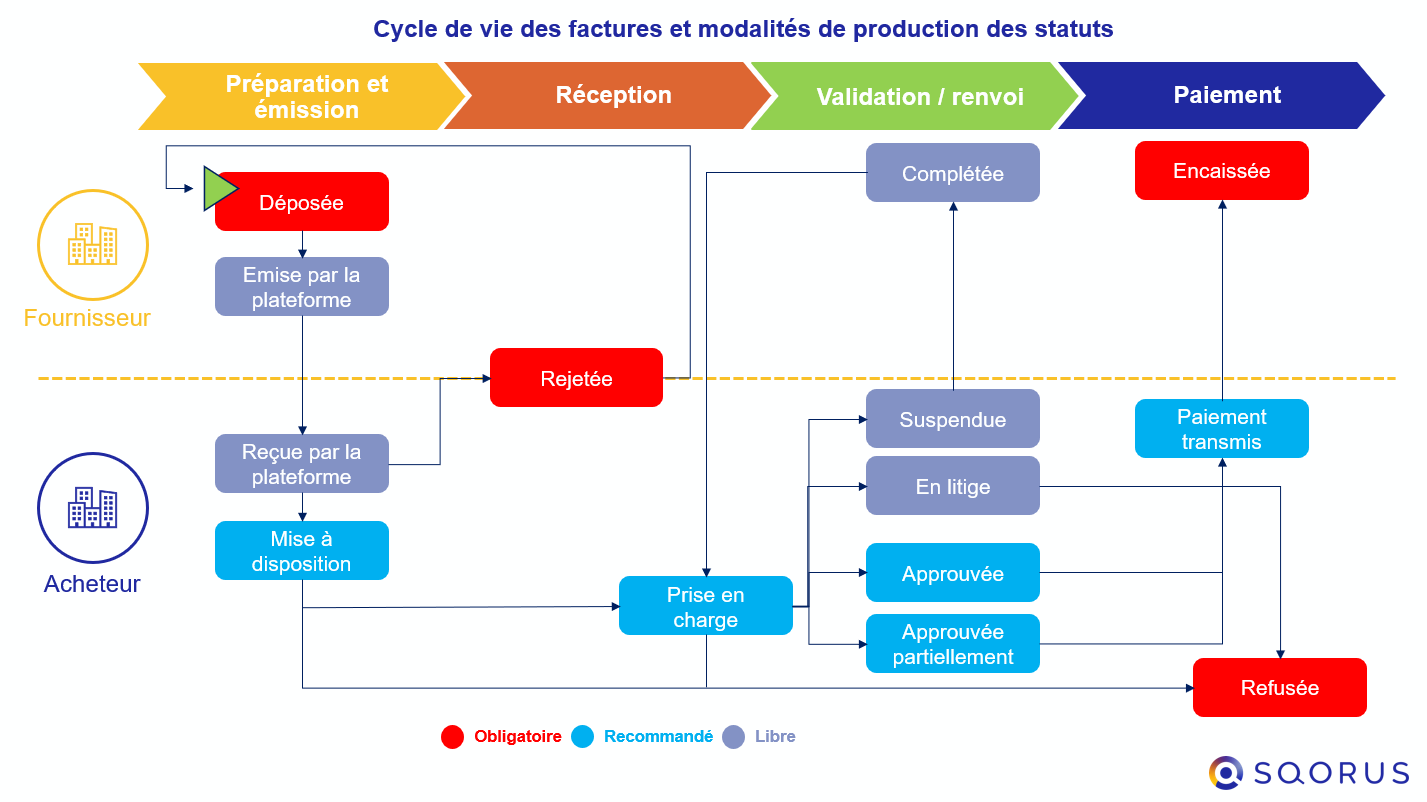

In addition, companies will have to report statuses related to the invoice life cycle, according to three transmission levels (Mandatory, Recommended and Free). A total of 14 statuses have been identified with responsibility for production shared between Buyer and Supplier.

Main Obligations of E-Reporting

Regarding the mandatory data for e-reporting, it is necessary to differentiate between B2C and international B2B operations. For international B2B operations, the required data will be the same as for e-invoicing, with the exception that the SIREN number will be replaced by the Intracommunity VAT number or a foreign identification number.

As for B2C operations, the data can be sent in an aggregated manner. However, if a company chooses not to aggregate the data, the following mandatory information must be included on the invoice:

| MANDATORY INFORMATION ON THE E-REPORTING | LAUNCH | TARGET |

|---|---|---|

| Period over which the transmission is made | X | |

| SIREN - Taxable person | X | |

| Invoice number | X | |

| Invoice date | X | |

| Option for payment of tax on the basis of debits | X | |

| Total amount of VAT to be paid, excluding any foreign VAT, and stated in EUR for transactions in foreign currency | X | |

| Transaction currency | X | |

| Transaction category: supply of goods subject to VAT / supply of services subject to VAT / supply of goods and services not subject to VAT / transactions giving rise to the VAT margin scheme | X | |

Source : https://www.impots.gouv.fr/specifications-externes-b2b

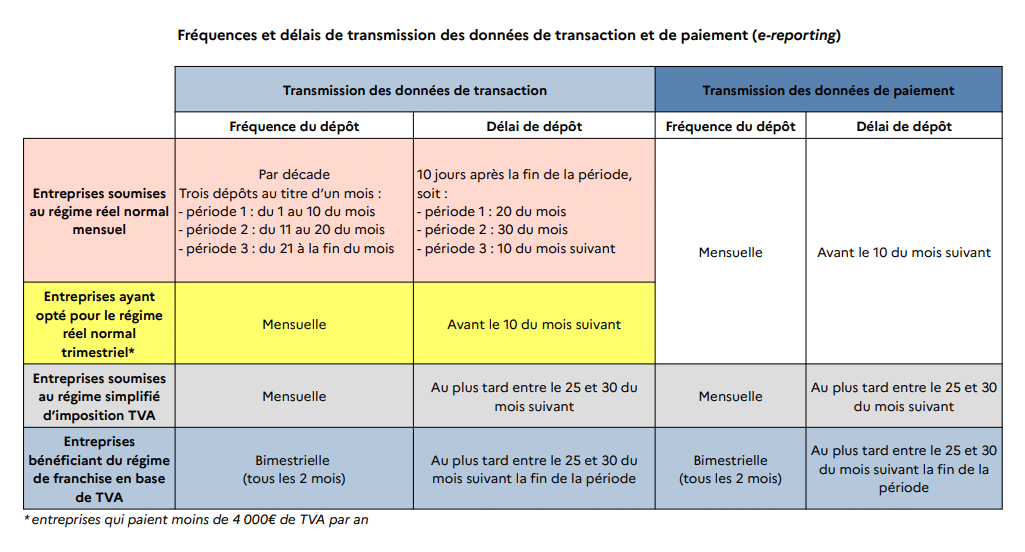

The tax administration has also established a specific schedule specifying the frequency and deadlines for sending data to the Public Invoicing Portal (PPF). It should be noted that only authorized Partner Dematerialization Platforms (PDP) will be allowed to transmit e-reportings to the PPF.

Focus on Controls Related to E-Invoicing and E-Reporting

To ensure data security, the PPF will be responsible for conducting controls that cover both data flows and invoices issued or received by companies. These controls have been identified at 4 levels:

- Technical Control: antivirus on invoice and attachment, empty file, file type and extension, authentication and signature verification, uniqueness of the flow (file name, etc.);

- Application Control: syntax analysis (CII, UBL 2.1, Factur-X);

- Functional Control: semantic format analysis (normative specificities), file uniqueness, data coherence (coding and references), addressing (directory);

- Business Control: data verification by the recipient’s business teams.

Conclusion on the Obligation of E-Invoicing and E-Reporting

In conclusion, with these new regulatory specifications, the implementation of compliance audits of application environments and processes becomes a key step in the successful transition of companies towards the application of the reform.

Planning these audits as early as possible will help secure the necessary alignments inherent to the challenges of the reform and smoothly accommodate both technical and organizational constraints. Given the globalization of commercial exchanges and the increasing number of countries adopting e-invoicing, the trend will likely move towards standard harmonization between countries, similar to what “SWIFT” achieved for international bank transfers.

On this subject, SQORUS, a consulting firm specialized in the digital transformation of HR, Finance, and IT functions, can support you with your electronic invoicing challenges. Feel free to contact us to discuss this further with our experts.

DOWNLOAD OUR LATEST WHITE PAPER

HOW SHOULD FINANCE BUSINESSES TRANSFORM THEMSELVES TO GENERATE ADDED VALUE AND DETECT GROWTH OPPORTUNITIES?

Also read on the topic of digital transformation of finance functions:

- The obligation of electronic invoicing and e-reporting

- Electronic invoicing reform: what you need to know

- What is the role of the finance department today?

- 5 obstacles to the digital transformation of finance functions

- Improve financial processes with automation and RPA

- What changes does dematerialisation bring to the finance function?

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company’s financial transformation

- From a Finance IS to a Finance Data System

- What are the key challenges facing finance managers today?

- What are the key regulatory issues for CFOs in 2023?

- Digitization of the finance function: what should we expect in the future?

- Finance management: what technological tools are available to CFOs?