The digital transformation of the finance function has been underway for several years now, just like other corporate functions. The latest technological advances, around the cloud, big data and artificial intelligence, have led to the deployment of integrated management solutions (ERP software), the pooling of services and the use of dematerialization tools. As a finance manager, where do you stand on the digital transformation of the finance function?

Why is digital transformation essential for the finance function?

Digital transformation is an essential step for companies that want to pursue dynamic growth over the long term. The finance function is truly supported by the digitalization of processes. Let’s remember that for more than a decade, CFOs have been aware that they must optimize their support functions in order to be more efficient and facilitate their decision-making.

The digital transformation of the finance function contributes to improving results and margins. It also relieves the workload of employees and leaves them more time to focus on more global issues.

Better productivity of support functions, thanks to new technologies

Since the Macron law of August 6, 2015 concerning the obligation to accept electronic invoices, dematerialization tools, coupled with the cloud and robotization, have been strongly favored by the finance function.

Indeed, beyond this law, CFOs already considered the implementation of process digitization as a matter of course. This not only improves productivity, but also makes the execution of process control easier and faster. The digital transformation of the finance function has made it possible to automate the manual review of accounting entries, streamline workloads and standardize year-end closing procedures.

Furthermore, digitalization has proven to facilitate the administration of the repository, orders and disputes with customers, as well as the control of interfaces and the recording of accounting entries. In other words, big data processing has become smoother and has led to more relevant data consolidation.

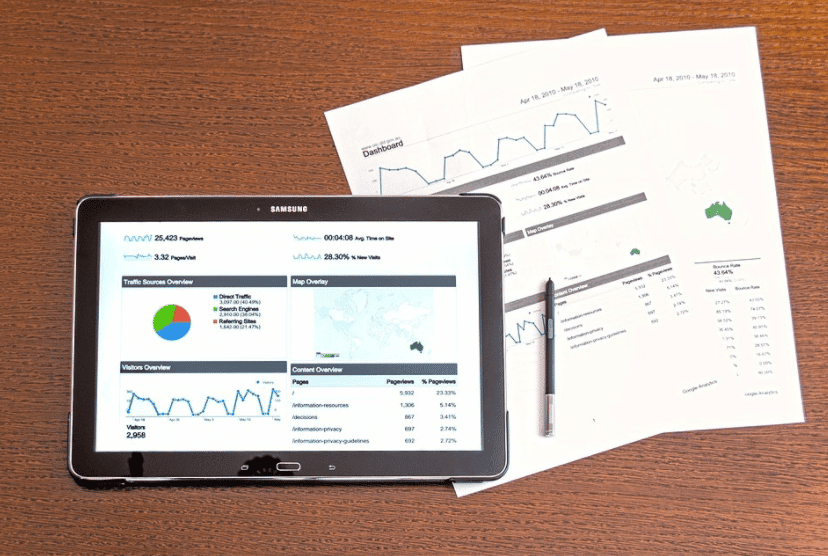

As a result, the quality of the data allows the finance department to be more precise and accurate in its participation in the company’s development strategy.

Digital transformation of the finance function: resources to improve

Although the finance function is succeeding in creating value and gaining in competitiveness and productivity, CFOs deplore the lack of necessary skills and knowledge among candidates and employees. They insist on the essential need to train and adapt the tools to the capacity of each person to adapt to new technologies.

Moreover, the automation of certain repetitive tasks related to the administrative management of invoices can allocate more time to analysis and even to management control. In this sense, CFOs need to update the capabilities of their employees and, at the same time, assess the real needs for new skills.

Digital transformation of the Finance function : how to identify growth opportunities?

Discover how Finance's digital transformation can optimize your company's performance, and effectively identify opportunities for growth.

Also read about the digital transformation of finance functions

- The obligation of electronic invoicing and e-reporting

- Electronic invoicing reform: what you need to know

- What is the role of the finance department today?

- 5 obstacles to the digital transformation of finance functions

- Improve financial processes with automation and RPA

- What changes does dematerialisation bring to the finance function?

- The finance function, an actor of change in the digital transformation of the company

- Predictive analytics to unlock value and detect growth opportunities

- Better managing talent to overcome the obstacles to digital transformation in the finance function

- Provide users with real-time data with data visualization

- Advanced financial analysis to improve decision support

- Identify the business processes in the finance function that would benefit most from digitization

- Security at the heart of the company's financial transformation

- From a Finance IS to a Finance Data System

- What are the key challenges facing finance managers today?

- What are the key regulatory issues for CFOs in 2023?

- Digitization of the finance function: what should we expect in the future?

- Finance management: what technological tools are available to CFOs?

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.