Compensation plays a crucial role in attracting and retaining talent within organizations. Professionals are looking for jobs that offer competitive remuneration, meet their financial needs and guarantee their future stability. To remain competitive, companies need to rethink their approach to compensation. Discover 3 innovations on compensation in 2023 to redefine the professional experience and foster commitment and performance within organizations.

The compensation is one of the key factors in attracting and retaining profiles and talent within a company.

Employees are often looking for jobs that offer competitive remuneration that enable them to meet their financial needs, as well as look after their families and their future.

By offering a attractive remuneration package, the company can attract qualified candidates for the position.

It can also encourage employees to stay with the company by offering salary increases, bonuses benefits, stock options, pension plans…

The remuneration package is nowadays a delicate matter, made up of several components that are important for a well-balanced remuneration package.

Among these components, we can mention 4:

- Fixed remuneration : remunerates performance of the work expected in the position

- Variable compensation : remunerates individual performance and/or job constraints

- Employee savings : involving employees in the company’s success

- Employee benefits : creating favourable working conditions

Against a backdrop of high inflation, we feel it’s essential to share with you thefollowing 3compensation innovations.

Compensation innovation #1: salary transparency

In France, there is no legal obligation for companies to make public their compensation of their employees.

However, since September 2018, the “Avenir professionnel” law has obliged companies with more than 50 employees to negotiate an agreement on professional equality between women and men every three years, which may include an obligation to pay transparency.

Under this agreement, companies are required to carry out an analysis of their pay practices, in order to identify any pay inequalities between men and women.

They must also put in place measures to correct them, and monitor the evolution of the situation.

In addition to these legal obligations, some companies may choose to make public their compensation of their employees for reasons of transparency and fairness.

However, this is still relatively rare in France, not least because of the culture of secrecy and the “taboo” surrounding wages.

It is also worth noting that salary transparency is not limited to gender equality.

It can also be an effective tool in the fight against all forms of pay discrimination, whether related to gender, age, ethnic origin or any other protected characteristic.

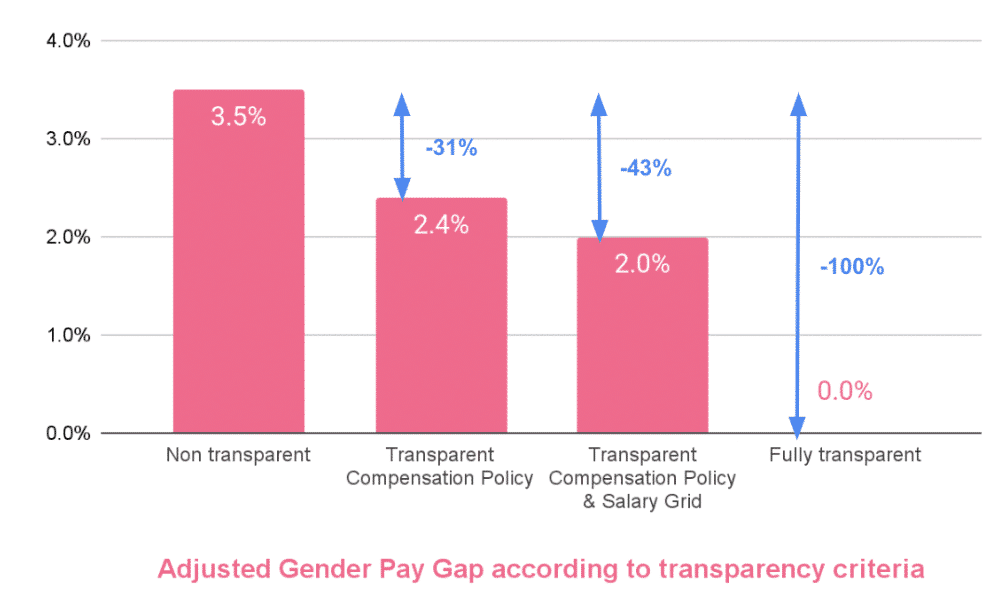

The adjusted salary gap, i.e. the average salary of men and women with the same position, the same seniority and living in the same place, is :

- 3,5% in non-transparent companies ;

- 2,4% for those who have only made their remuneration policy transparent ;

- 2% for those with a transparent remuneration policy and pay scale;

- 0% for those who have opted for full transparency of individual salaries.

According to Samuel Durand, lecturer on the future of work and author of Work In Progress (Eyrolles, 2022), only 8% of French companies share their salary grids compared with 12% in Germany and 15% in the UK.

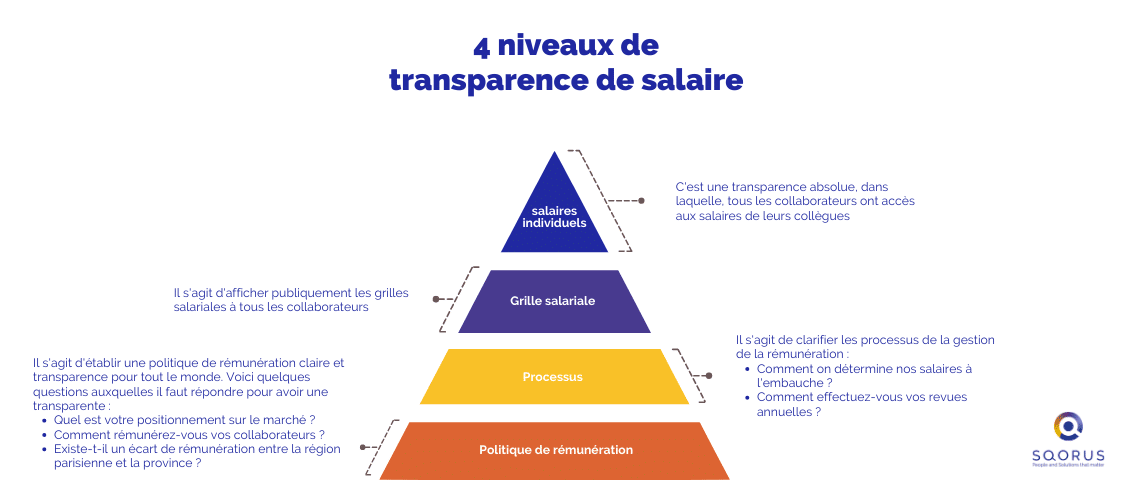

There are 4 levels ofsalary transparency :

This transparency of salaries within a company creates an atmosphere of overall fairness and employee motivation. They know they’re being paid what they’re worth, and that they’re not at a disadvantage compared to other colleagues. Financial discrimination is one of the main causes of employee demotivation and resignation.

Nowadays, few companies opt for salary transparency, which presents a unique competitive advantage for the minority of companies that do. In fact, when recruiting, this enables candidates applying for a vacancy to project their potential development throughout their career with the company. It also saves the recruiter time, as candidates who apply to this type of ad are generally in tune with the remuneration on offer.

By adopting transparent compensation policies, companies strengthen their competitiveness on the job market and attract the best talent.

Transparent salaries also help to create a positive corporate culture, focused on fairness and valuing employees.

The pay transparency is often accompanied by complementary measures, such as and profit-sharingschemes, as well as employee benefits, designed to promote the loyalty and employee commitment.

This approach also helps to improve company performance by creating a climate of trust conducive to collaboration and professional fulfillment.

To anticipate the recruitment challenges of tomorrow, it is essential to develop solid adaptation strategies. In our dedicated article, you’ll find the keys to adapting as a recruiter and remain effective in a constantly changing environment.

Innovation in remuneration #2: innovative remuneration formats

We can’t talk about compensation not to mention inflation and its impact on employees’ daily lives. France is currently experiencing high inflation for a number of national and international reasons. It is a major concern for the French, as it increases the cost of living and reduces purchasing power.

Employers are called upon to support their employees during these delicate moments. However, it remains difficult for companies to keep up with inflation in terms of salary increases for all employees. Indeed, some companies are themselves in difficulty.

Innovating fixed remuneration with new formats

One of the challenges lies in the different forms of remuneration. We are seeing the emergence of new formats for fixed remuneration:

- Pay-as-you-go some companies have begun to offer on-demand payments for employees who need immediate access to their salary. This can help employees avoid high-interest payday loans or manage unexpected expenses. Other companies buy back their employees’ RTT days by paying them overtime.

- Flexible remuneration : employers pay part of the salary in the form of flexible remuneration for employees (additional leave or teleworking days).

- Non-monetary compensation : employers offer non-monetary benefits such as health care, parental leave, wellness programs, educational benefits…

Innovative compensation and benefits

Companies are also investing in social benefits that can help and relieve employees in their daily lives. These services are diverse, varied and specific to each company:

- Flexible financial benefits : more and more employers are offering reimbursement options for expenses such as childcare, healthcare or 100% of transportation costs, allowing employees to choose the benefits that suit them best.

- Additional paid leave: some companies offer days off for personal care or volunteer activities, to support employees in their personal and professional lives.

- Retirement planning : employers offer retirement planning programs to help employees prepare for their financial future. Several companies, such as Carrefour, offer 30-minute consultations with a financial coach to their employees nearing retirement, so that they can better manage and optimize their savings investments.

By recognizing the importance of compensation and benefits in employees’ working lives, companies are contributing to employee motivation and commitment.

Continuing the trend of innovative compensation formats, socially responsible savings is another facet of compensation innovation.

Individual annual interviews are often perceived as inefficient and a source of stress for employees. Yet they play a crucial role in the professional development, motivation and performance of teams. Find out more in our dedicated article, 3 ideas to innovate around interviews and performance.

Innovation in compensation #3: socially responsible savings

More and more employees are becoming aware of environmental and social issues as citizens, and expect their employer to set an example.

Investment funds have economic, social and environmental impacts, depending on the companies they finance.

The Plan d’Épargne Entreprise (PEE) and the Plan d’Épargne pour la Retraite Collectif (PERCO) are employee savings schemes that enable employees to build up long-term savings by investing part of their remuneration (profit-sharing, incentive schemes, etc.) in financial products.

Company Savings Plan

The PEE is one of France’s leading employee savings schemes. It allows you to block a sum of money for important life events (property purchase, marriage/PACS, birth…).

The Collective Retirement Savings Plan (Plan d’Épargne pour la Retraite Collectif)

The PERCO is also an employee savings scheme that enables employees to build up savings, notably for their retirement.

The funds on offer are more or less responsible. They are assessed according to ESG (Environment, Social and Governance) criteria.

ESG criteria are increasingly used to assess the performance of companies and investments, as they enable environmental, social and ethical considerations to be factored into financial decision-making. Investors can thus use ESG criteria to assess the risk associated with an investment and to select companies that are better aligned with their values and objectives.

Companies can therefore communicate and suggest to their employees that they invest their PEE or PERCO in socially responsible funds, enabling them to finance companies that have a positive impact on their ecosystem. This gives employees the chance to get involved in social and environmental causes.

By integrating socially responsible savings into their pay policy, companies are boosting employee satisfaction, improving direct compensation and helping to build a more sustainable future.

With the latest health crisis, employees are increasingly looking for ways to upgrade their skills in order to renew and adapt. Companies must therefore innovate in the area of training to respond to these searches and continue to attract and retain talent. In our dedicated article, discover innovative ways to support your employees in their professional development.

Conclusion on HR innovation in compensation in 2023

In conclusioninnovation in compensation is essential to creating a dynamic corporate culture and fostering employee loyalty.

By optimizing compensation packages and benefits benefits benefits, organizations strengthen their competitiveness and contribute to the professional well-being of their teams.

This article is part of a series of articles dedicated to HR innovation , the fruit of research, analysis and reflection by the LAB SQORUS teams.

At SQORUS, our HR Council teams can help you review policies, processes and tools for all aspects of the HR function, including compensation. If you are interested in this topic, please contact us to discuss it.

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.