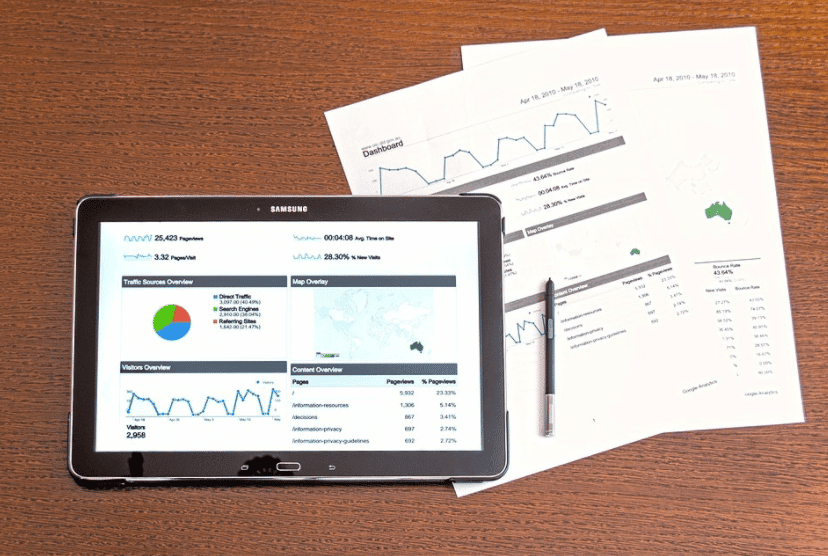

In 2024, a French energy company launched a strategic review of its information system(IS), against a backdrop of strong growth and the recent opening up to the consumer market. With billing and payment volumes multiplying, the finance department was faced with a fragmented, inflexible system that was difficult to use: fragmented customer vision, operational slowness, heterogeneous tools, financial data that was difficult to consolidate.

Faced with these structural limitations, the organization quickly realized that a simple tooling project would not suffice. The choice of a new ERP Finance and CRM system had to be managed as a transformation lever in its own right, and not as just another technical decision.

This case is far from isolated. As finance departments have to combine agility, compliance and extra-financial management, IS overhaul projects are becoming critical. Poorly prepared, they come to nothing. Properly managed, they can have a lasting impact on performance.

A strategic decision, still too often approached as a technical project

Choosing a Finance IS in 2025 is no longer a simple IT project. It’s a decision that will be binding for decades to come, sometimes even longer. It will determine a company’s ability to structure its performance, ensure the reliability of its data, meet ESG requirements and adapt to an uncertain economic environment.

Yet in many organizations, the selection process remains under-invested. It is often driven by technical constraints, internal habits or vendor bias. The result is well known: disappointing projects, functional rigidity, limited buy-in and hidden costs.

The root cause? An ill-framed, ill-governed and ill-equipped selection process.

SI Finance: drifts observed in the field during the selection phase

Every year, we meet finance and IT managers who are embarking on an ERP or EPM transformation project with commitment and ambition. But very often, the upstream phase – the choice phase – is rushed, without a solid methodological framework, and without a shared understanding among all stakeholders.

The errors are recurrent:

- Needs are poorly expressed or overly influenced by existing solutions;

- The selection criteria are not aligned with the real transformation challenges;

- Governance is unclear, roles poorly distributed, arbitration poorly documented;

- Editor demonstrations are poorly structured, too marketing-oriented, and poorly correlated with business scenarios;

- The final assessment is based on subjective impressions, not formal scoring.

This lack of rigor doesn’t simply result in a poor technical choice. It compromises the transformation dynamic.

In 2025, choosing a Finance IS is a more complex and critical exercise

The Finance IS market has undergone a profound transformation. It’s no longer a question of pitting Oracle against SAP, or choosing between cloud and on-premise. Today’s offerings combine :

- Full cloud or hybrid ERP with quarterly release cycles;

- Advanced features for automation (RPA), prediction (AI), consolidation ;

- ESG-native tools integrated into financial modules ;

- Open, interoperable, API-driven platforms.

In this technological landscape, CFOs have to combine two requirements: remain agile and compliant at the same time.

Their role now goes beyond cost control. They must :

- Actively contributing to overall performance

- Reduce closing times and increase responsiveness

- Integrate extra-financial dimensions into their reporting

- Reliable data for shareholders, regulators and operational staff

Finance IS becomes a condition of strategy, not a mere support.

Before the tool, the method: making your Finance IS project a success from start to finish

It’s in response to this reality that we’ve designed an operational guide to help you make the right IS Finance choice.

It’s aimed at decision-makers: CFOs, CIOs, in-house project managers, transformation sponsors – all those who know that a good tool doesn’t make the transformation happen, but that the wrong choice can block it for a long time.

Here’s what you’ll find:

- A comprehensive selection methodology, structured in phases: scoping, expression of needs, governance, selection matrices, demonstrations, final scoring.

- The criteria that count in 2025: real interoperability, functional scalability, security and resilience, native compliance, projected TCO and ROI.

- Reusable tools: checklists, MoSCoW matrices, AHP, comitology templates, demonstration scenarios, specifications template.

- A complete case study: support for one of France’s leading energy companies, from diagnosis to short-listing.

- A 2030 projection: predictive finance, continuous closing, CSR at the heart of management, hybrid cloud/on-premise architectures, real-time management.

Conclusion: a structuring project deserves a structured approach

At a time when Finance Departments must reconcile agility, compliance and extra-financial management, the choice of an IS is no longer a purely technical issue. It is a strategic moment, often underestimated, but decisive for the years to come.

This Ebook proposes a concrete, replicable, field-based method for transforming selected solutions into real performance drivers.

No jargon. No overpromising. Just a clear, aligned and robust method.

Read more

Why our Ebook “How to choose the ideal Finance IS in 2025?”

- Because you won’t be changing your IS Finance every year.

- Because the wrong choice will cost you years of inertia, internal tensions and loss of competitiveness.

- Because the right choice, properly framed and governed, can transform your performance over the long term.

Looking for a structured method, concrete tools and comprehensive field feedback? Our Ebook “Réussir le choix de son SI Finance” will be published next week (June 23, 2025). Not to be missed if you’re planning a project in 2025.

Contact

A project? A request?A question?

Contact us today and find out how we can work together to make your company’s digital future a reality.